Over the past years Tanzania has witnessed a large increase in Mobile App Loans. You can now use your smartphone to download an App, apply for a loan, receive funds, and repay digitally. Below are details about some of the major digital lenders (Mobile App loans) in Tanzania.

NB: The list contains only BOT Approved Digital Lenders;

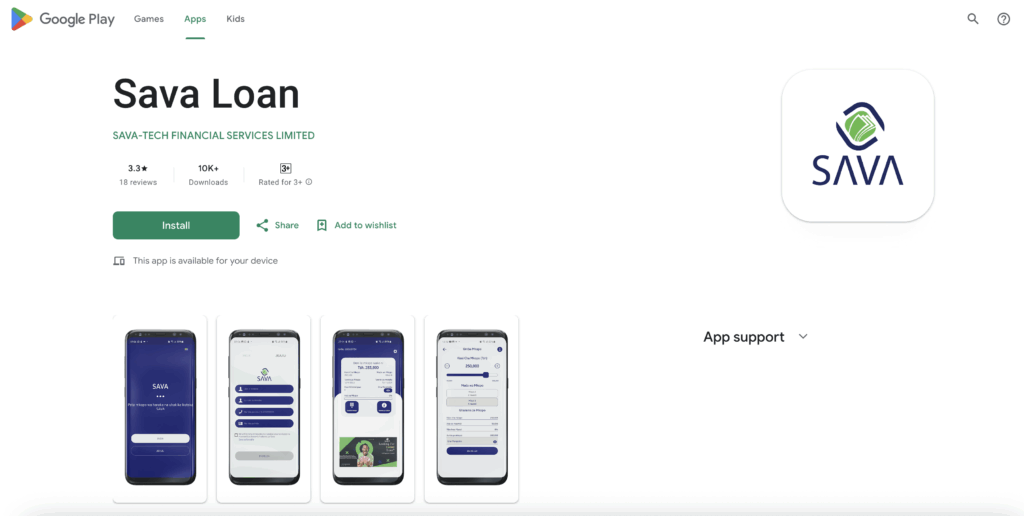

Sava Loan

Benefits

- Employees & SMEs Loans

- A monthly interest rate of around 5% plus management fees, insurance etc.

Requirements

- At least 18 years old.

- Have a mobile money account.

- Have a valid National Identification Number (NIDA)

Procedure

- Download Sava Loan App and Register

- Fill loan application form and request amount

- Verification: NIDA

- Once approved (and after review by “Sava ambassador”), funds are disbursed to your mobile money account.

- Repay monthly per schedule.

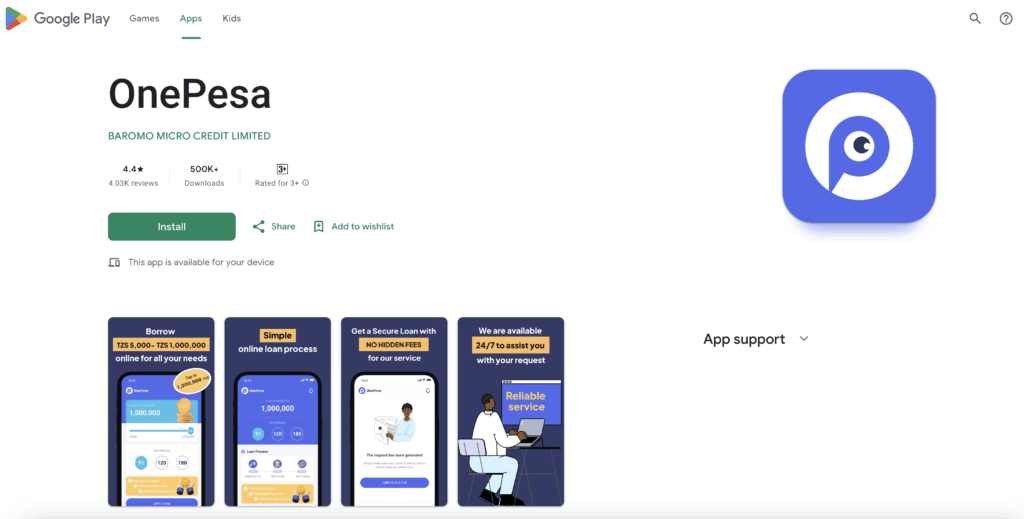

OnePesa

Benefits

- Loan of up to 180 days

- Maximum service fee: 32%.

Requirements

- At least 18 years old.

- Tanzanian citizen or legal resident.

- Must have a mobile money account for disbursement & repayment.

Procedure

- Download OnePesa app.

- Fill out online application with your basic details.

- Application review.

- If approved, funds sent to your mobile money account.

- Repay via mobile money.

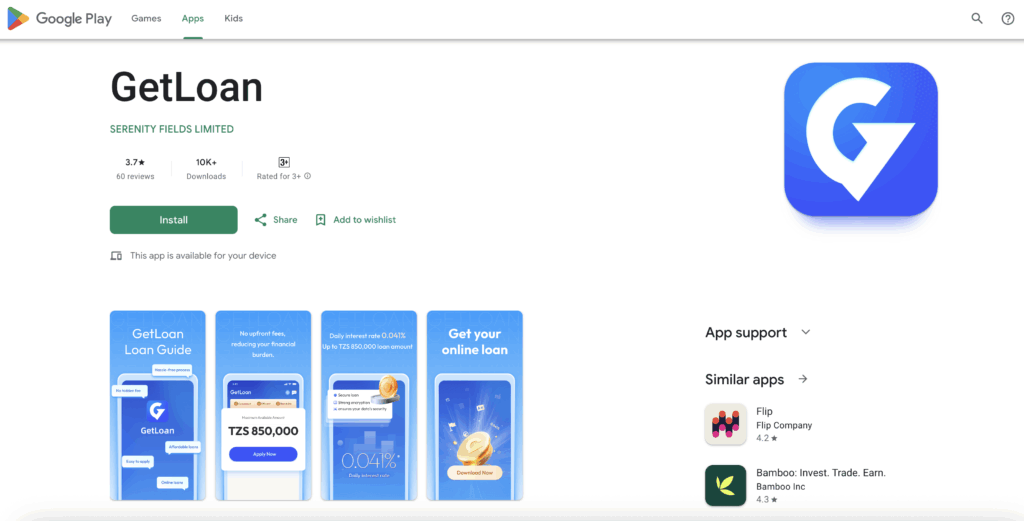

GetLoan

Benefits

- Loan amounts of up to TZS 850,000.

- Loan term is between 3 to 12 months

Requirements

- Must be Tanzanian citizen.

- Age between 18 and 50 years old.

- Must have a regular source of income.

Procedure to get a loan

- Download the GetLoan App.

- Register by providing your personal information and proof of identity.

- Apply by selecting amount and repayment duration.

- Wait for approval. Once approved, funds are disbursed

PalmPay TZ

Benefits

- Loan amounts from TZS 10,000 to TZS 1,000,000.

- Repayment periods of 61 to 180 days.

Requirements

- Must be Tanzanian citizen with national ID card.

- Age between 18 and 55.

- Must have a job or ability to repay loan.

Procedure

- Download PalmPay app.

- Register / open an account.

- Submit loan application via app.

- If approved, loan is deposited into your linked mobile money wallet.

Kuza Capital

Benefits

- Kuza Capital targets small business owners, farmers, market vendors.

Requirements / Eligibility

- Must be Tanzanian citizen with national ID card.

- Age between 18 and 55.

- Must have a job or ability to repay loan.

Procedure

- Download and register on the Kuza Capital app.

- Provide personal details to request a loan.

- Application is reviewed; upon approval, the funds are disbursed

Easybuy

Benefits

- Loan Limit of up to TZS 1,000,000.

- Loan duration of up to 1 year

Requirements / Eligibility

- Valid ID

- Have a Smartphone

Procedure to get a loan / device

- Download Easybuy app and register.

- Pay the down payment.

- The rest of amount is financed via instalments across the chosen term.

- Make repayments as scheduled.

TZCash

Benefits

- Loan Terms of up to 6 months

Requirements / Eligibility

- Must be Tanzanian citizen, over age 18.

- Must have a mobile wallet account (Vodacom, Airtel, or Tigo) for disbursement/repayment.

- Must have a smartphone with internet connection.

Procedure to get loan

- Download TZCash from Google Play.

- Fill application in app, step by step with personal info. Identity verification via protected system.

- Upon approval funds are disbursed to your mobile wallet.

- Repay on time per schedule; you can also repay early without penalty.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Loan terms, interest rates, service fees, and eligibility requirements may change at any time without prior notice. Always verify details directly on the official Mobile App or with the lender before making any financial decisions. Borrow responsibly, and only take a loan if you are confident you can meet the repayment terms. The author and publisher are not liable for any financial losses or consequences arising from the use of the information provided.