The Tanzania Communications Regulatory Authority (TCRA) has published its quarterly report for April to June 2025. The report highlights significant growth in mobile subscriptions, internet usage, mobile money, and broadcasting, while also providing insights into tariffs, quality of service, and fraudulent activity. The findings underline Tanzania’s rapid digital transformation and increased reliance on mobile-driven services.

1. Telecom Subscriptions

- Total subscriptions grew by 2.6%, from 90.4 million in March 2025 to 92.7 million in June 2025.

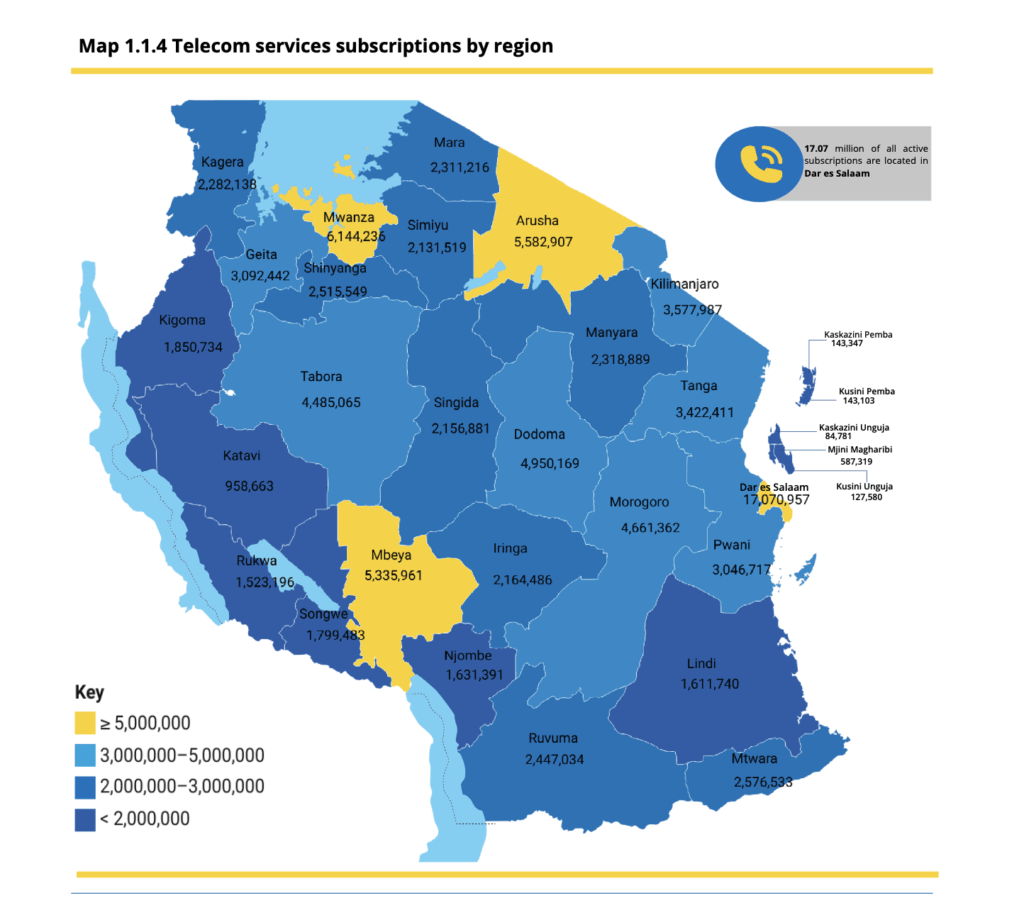

- Dar es Salaam accounted for the highest share with 17.07 million active subscriptions, followed by Mwanza (6.14M), Arusha (5.58M), Mbeya (5.34M), and Dodoma (4.95M).

- Market share: Vodacom led with 32.1%, followed by Yas (28.1%) and Airtel (22.4%).

2. Tariffs

- Local tariffs remained unchanged: TZS 26 (on-net) and TZS 28 (off-net) per minute.

- East Africa (EA) roaming tariffs dropped by 61% to TZS 247.52 per minute.

- Rest of the World (RoW) tariffs rose by 12% to TZS 2,175.15 per minute.

- Local SMS averaged TZS 7.80, international SMS TZS 189.60, and data TZS 9.35 per MB.

3. Voice and SMS Traffic

- Domestic voice traffic rose 6.6% to 43.3 billion minutes, with June recording the highest volume.

- International traffic also grew: calls to East Africa increased 20%, and calls received from EA rose 10%.

- SMS traffic increased 6%, reaching 52.8 billion in June, up from 50.0 billion in March.

4. Internet Usage

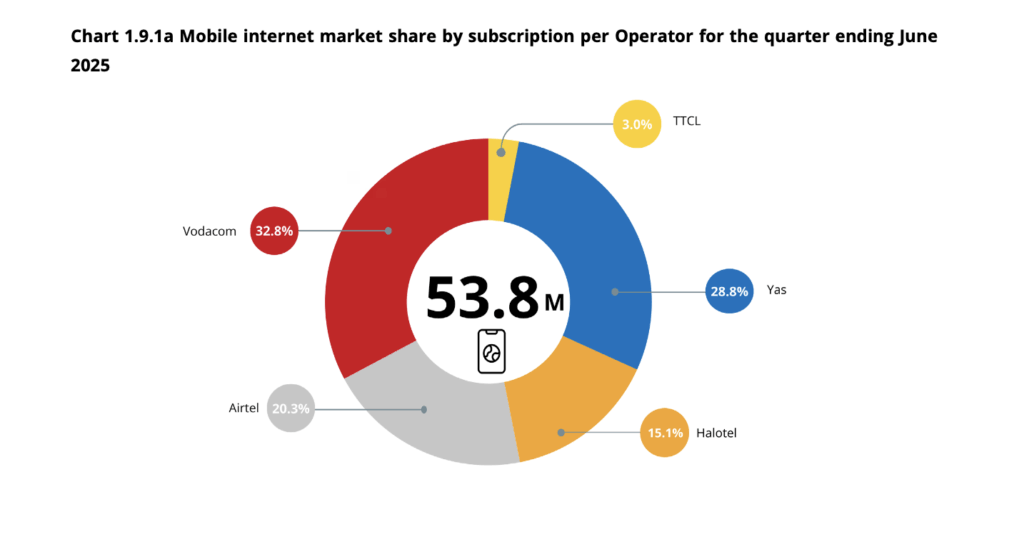

- Internet subscriptions grew 9.6%, from 49.3 million in March to 54.1 million in June 2025.

- Internet penetration reached 79.3% of the population.

- Mobile broadband dominated with 99.5% of subscriptions.

- Data usage rose by 14.7% to 633 petabytes, with an average of 4.03 GB per subscriber in June.

5. Mobile Devices and Infrastructure

- Smartphone penetration increased to 36.7%, while feature phone penetration remained high at 84.9%.

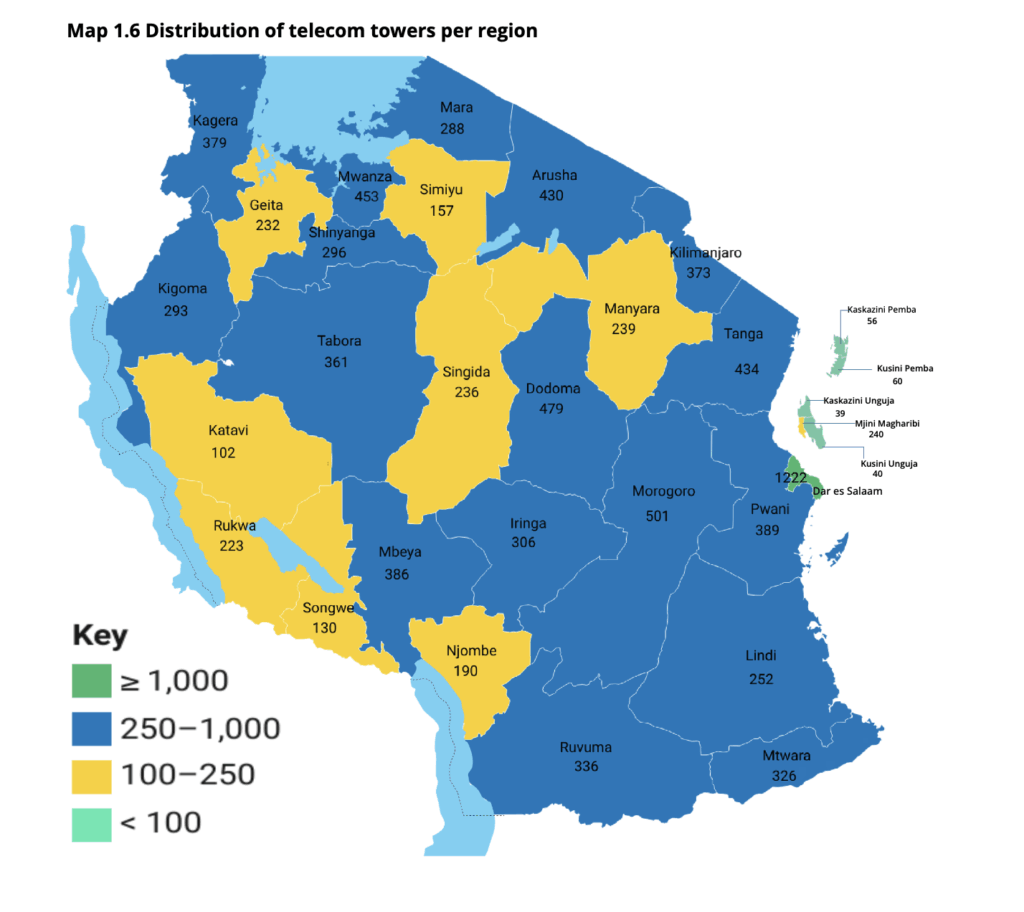

- Tanzania had 9,448 telecom towers by June, with Dar es Salaam leading (1,222 towers).

- 5G rollout expanded by 11%, with 1,038 active gNB stations, mainly in urban centers.

- Population coverage: 2G (98.6%), 3G (93.4%), 4G (92%), and 5G (26%).

6. Mobile Money

- Mobile money accounts rose by 2%, from 66.5 million in March to 68.1 million in June 2025.

- Major providers (M-Pesa, Yas Mixx, Airtel Money) controlled 89% of the market.

- Transactions reached 5.27 billion for the quarter, a strong growth compared to March 2025.

7. Quality of Service (QoS)

- Network availability exceeded 99% for most providers.

- Call connection success rate met the 98% threshold across most networks.

- Call drop rates were below the 2% compliance level, with Yas and Halotel performing best.

- Industry average QoS scores: Yas (100%), Halotel (95%), Vodacom (94.7%), Airtel (92.9%), TTCL (81.3%).

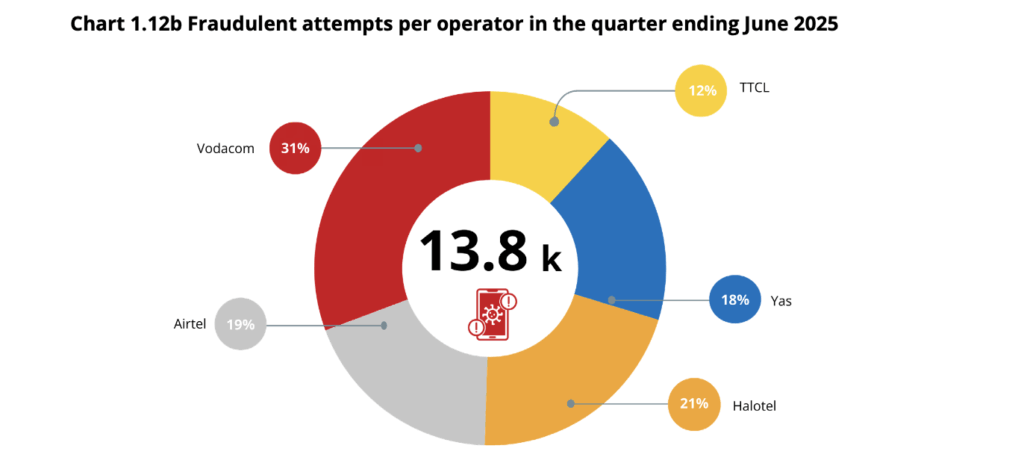

8. Fraudulent Attempts

- Fraudulent attempts dropped by 19%, from 17,152 cases in March to 13,837 in June 2025.

- The highest cases were reported in Rukwa, Morogoro, Dar es Salaam, Mbeya, and Kilimanjaro.

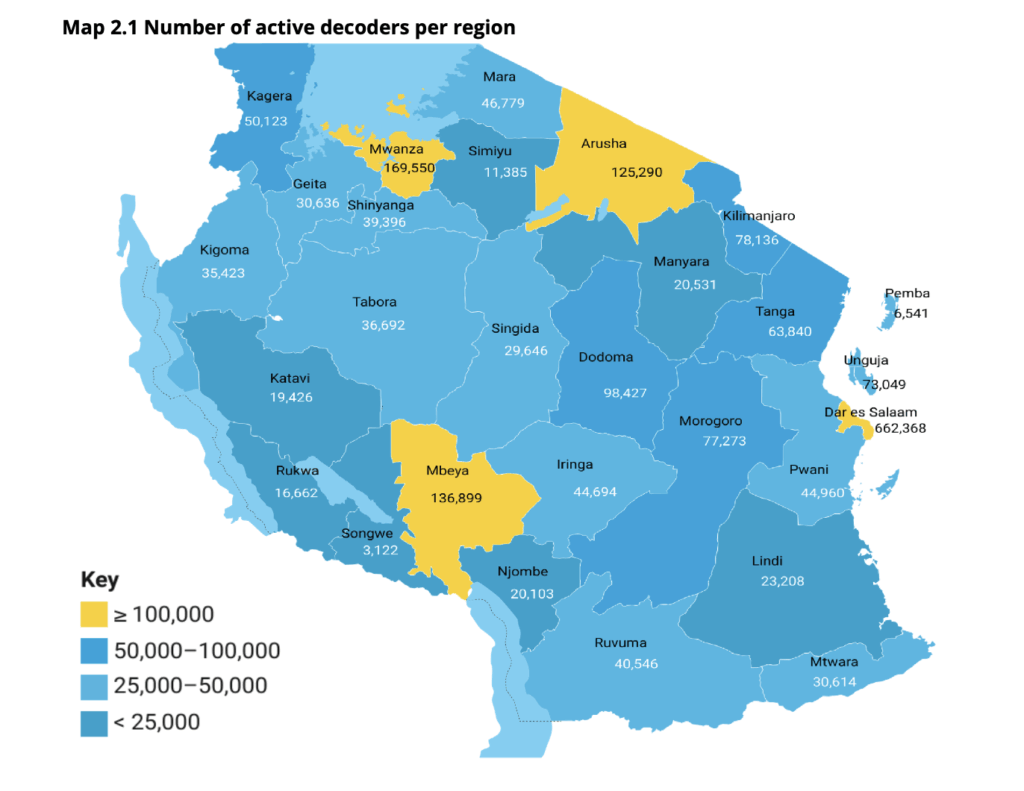

9. Broadcasting and Postal Services

- Active decoder subscriptions stood at 25 million, while cable TV subscriptions reached 2 million.

- Posted items: 559,529 domestic and 61,602 international.

- Delivered items: 954,732 domestic and 76,784 international.