The Tanzania Communications Regulatory Authority (TCRA) released its quarterly communications sector report for April to June 2025, providing insights into mobile subscriptions, internet usage, mobile money, infrastructure, quality of service, broadcasting, and fraud control.

Halotel Tanzania, a key telecom operator, continued to expand its footprint, focusing on rural connectivity and affordable packages. While smaller in scale compared to Vodacom, Yas, and Airtel, Halotel demonstrated resilience in subscriptions, mobile money adoption, and quality of service. The following is a detailed review of Halotel’s performance across all categories.

Subscriptions (SIM card base and market share)

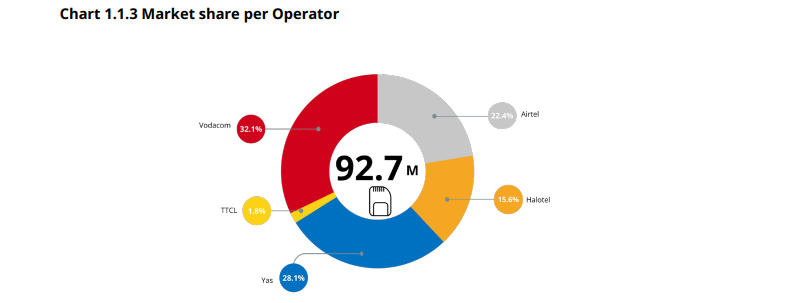

- Halotel P2P subscriptions in June 2025 were 14,363,854, M2M subscriptions were 78,687, giving a combined operator total of 14,442,541 as of June 2025.

- Nationally, total subscriptions were 92,735,798 in June 2025, therefore Halotel accounted for approximately 15.6% of all subscriptions, and roughly 15.7% of P2P subscriptions (Halotel P2P ÷ total P2P).

- Interpretation for corporate planning: Halotel’s subscriber base is materially larger than small-operator scale and represents a meaningful share of the market, positioning the operator as a national player with scale, and the operator should treat subscriber retention and ARPU strategies as priorities given that the top three operators still control the majority of the market.

Mobile money (HaloPesa)

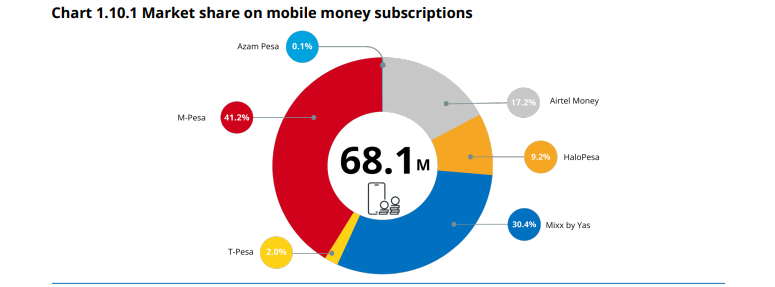

- Active HaloPesa accounts for June 2025: 5,907,180 accounts.

- HaloPesa recorded 42,215,295 mobile-money transactions in the quarter ending June 2025, a significant transactional footprint that confirms HaloPesa’s role in the national payments ecosystem even though it trails the absolute transaction volumes of M-Pesa and T-Pesa in the sector aggregate.

- Trend note: HaloPesa saw a month-on-month decline in active accounts from May to June 2025 (May 6,249,543 → June 5,907,180) indicating either seasonality or churn that merits commercial and product attention to understand causation and to stabilise growth.

Network infrastructure and towers

- TCRA reports 9,448 telecom towers nationwide for the quarter ending June 2025, with Dar es Salaam leading with 1,222 towers; the report provides regional tower distribution and radio-base station counts by technology (2G/3G/4G/5G) but does not publish operator-level tower counts in the public tables, therefore an operator-by-operator tower total for Halotel is not available within the TCRA quarterly release.

- The regulator’s radio base station inventory shows broad 2G/3G/4G rollout and a nascent 5G footprint (1,038 gNBs nationally), giving Halotel (and peers) a clear landscape for planning further coverage and capacity investments; Halotel’s QoS pass rates (detailed below) imply targeted infrastructure performance at measured sites, but the precise site count per operator will require internal asset data or TCRA-released operator breakdowns not present in this public summary.

Quality of Service

- Composite QoS score for Halotel: 95.0% (TCRA composite index April–June 2025)

- Network availability: Halotel met the regulator’s >99% availability target in 14 of 17 measured service areas, a strong outcome but with clear scope to get to 17/17 measured areas.

- Call Connection Success Rate: Halotel passed the 98%+ threshold in 14 of 17 measured areas.

- Call Setup Time: Halotel passed in all 17 measured service areas (target < 8 seconds), a positive performance indicator for voice UX at the measured sites.

- Call Drop Rate: Halotel passed the target in all 17 measured service areas (target < 2%), indicating good stability of voice connections in the sampled areas.

- SMS Delivery Time: Halotel passed in all 17 measured service areas (target < 2 seconds), which supports reliable SMS-based services (alerts, 2FA, USSD fallbacks)

- Download speed and data: Halotel passed download-speed thresholds in all measured areas applicable to the test set and met data-latency targets in 14 of 17 measured service areas solid for current 4G use cases but continued investment will be needed to match the best performers on data latency and coverage for 5G-grade services.

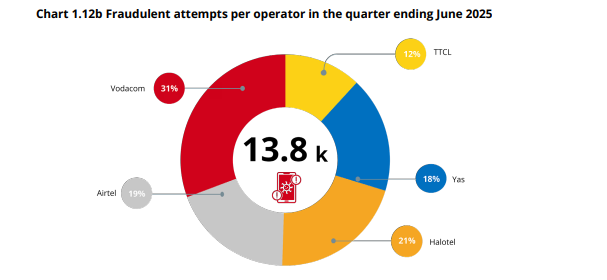

Fraud attempts and security posture

- Recorded fraudulent attempts logged on Halotel for June 2025: 2,882, a +67% change versus March 2025 (1,724) – this is a material increase at operator level even though sector total fraudulent attempts fell by 19% quarter-on-quarter.