The Tanzania Communications Regulatory Authority (TCRA) has released its quarterly communications sector performance report for April to June 2025. The report provides a comprehensive overview of industry developments across mobile subscriptions, internet services, mobile money, infrastructure, quality of service, broadcasting, and fraud control. Airtel Tanzania, one of the country’s leading telecom operators, maintained a strong market presence, consolidating its position as the third-largest operator while continuing to grow its digital finance and mobile broadband services. Below is a detailed breakdown of Airtel’s performance across all key categories.

Mobile Subscriptions

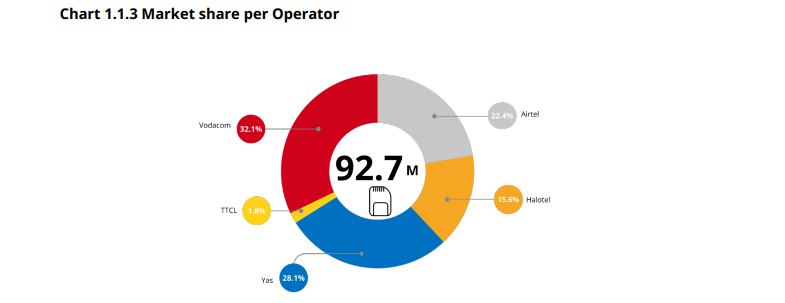

Airtel Tanzania closed the quarter with a 22.4% market share, ranking third after Vodacom (32.1%) and Yas (28.1%)

- Airtel’s active subscriptions rose from 20.3 million in March 2025 to 20.8 million in June 2025, contributing significantly to the national total of 92.7 million SIM cards.

- The company’s strong performance was supported by competitive data bundles, loyalty programs, and promotional offers targeting both rural and urban customers.

- Airtel’s subscription base remained concentrated in key regions such as Dar es Salaam, Mwanza, and Arusha, though the company has been expanding steadily in underserved areas.

Voice Services

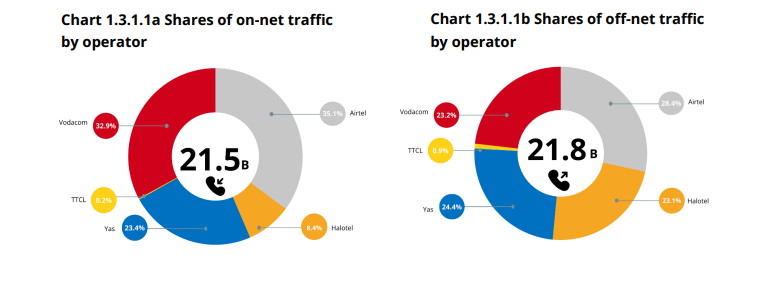

Airtel played a key role in driving national voice traffic, which rose to 43.3 billion minutes, a 6.6% increase from March

- Airtel contributed a sizeable share of both on-net and off-net traffic, maintaining strong interconnection volumes with competitors.

- Voice usage was supported by its bundled packages and favorable off-net pricing strategies, which enhanced customer retention.

SMS Services

The national SMS market grew by 6%, with traffic reaching 52.8 billion messages in June 2025

- Airtel continued to be a significant contributor to SMS volumes, leveraging bulk SMS partnerships with businesses and financial service providers.

- Off-net SMS directed to Airtel’s network remained substantial, showing its importance in B2C communication and mobile marketing.

Internet and Data Services

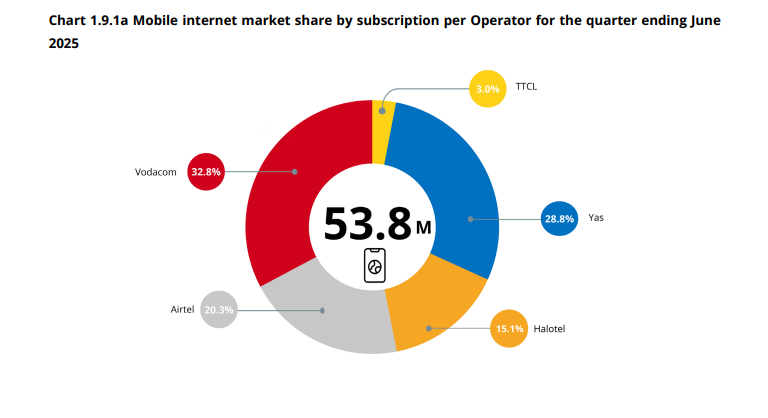

Airtel demonstrated strong growth in internet subscriptions and usage.

- Out of 54.1 million internet users in Tanzania by June 2025, Airtel captured a significant portion, reinforcing its role as a major broadband provider

- Airtel customers contributed to the national total of 633 petabytes of data consumed, a 14.7% increase from March.

- Average consumption reached 4.03 GB per user per month, with Airtel benefiting from aggressive 4G promotions.

- Speed tests placed Airtel as a competitive operator, achieving average download speeds of 15.7 Mbps and latency of 121 ms, ranking behind Vodacom and Yas but ahead of some smaller players.

Mobile Money (Airtel Money)

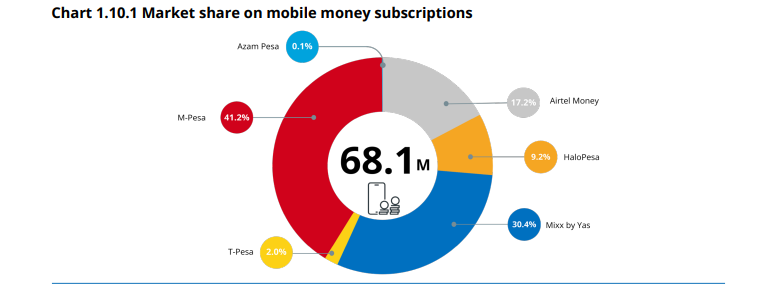

Airtel Money continued to hold a significant position in Tanzania’s digital financial ecosystem.

- Airtel Money accounted for 24.1% of mobile money subscriptions, closely competing with Yas Mixx (23.7%)

- National mobile money subscriptions increased from 66.5 million in March to 68.1 million in June 2025, with Airtel contributing to this growth.

- Airtel Money transactions formed part of the 5.27 billion transactions recorded nationally during the quarter.

- Airtel’s ecosystem supports merchant payments, utility bill payments, and remittances, reinforcing financial inclusion efforts.

Infrastructure and Cell Towers

Airtel continued to expand its infrastructure footprint.

- Out of Tanzania’s 9,448 telecom towers, Airtel owns and operates a significant share

- Airtel has been actively upgrading 4G sites and participating in 5G rollout projects, particularly in urban and peri-urban regions.

- Its infrastructure investments supported broader national coverage figures of 2G at 98.6%, 3G at 93.4%, 4G at 92%, and 5G at 26%, with Airtel steadily contributing to the expansion of next-generation services.

Quality of Service (QoS)

Airtel achieved compliance across most QoS indicators, though it ranked lower than Vodacom, Yas, and Halotel in overall performance.

- Network availability: Airtel met the >99% requirement in 15 out of 17 regions

- Call connection success rate: Airtel achieved compliance in 16 out of 17 service areas.

- Call drop rate: Within the <2% threshold across most areas.

- Download speeds: Averaged 15.7 Mbps, which was below Vodacom (22.4 Mbps) and Yas (19.6 Mbps), but ahead of TTCL.

- SMS delivery: Airtel passed the <2 second standard in all test regions.

- Overall, Airtel scored 92.9% in QoS compliance, ranking fourth among national operators.

Fraud Attempts

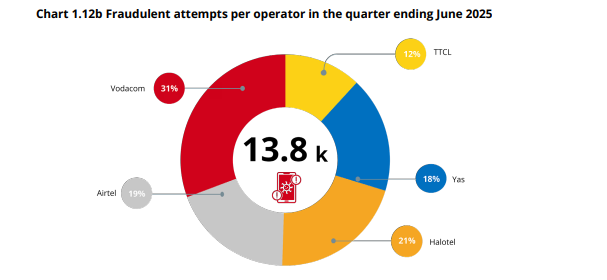

TCRA reported a 19% national decline in fraud attempts, from 17,152 cases in March to 13,837 in June 2025.

- Airtel recorded a moderate level of fraudulent activity, higher than Yas but lower than Vodacom.

- The company has strengthened its SIM registration processes and enhanced fraud detection systems to reduce vulnerabilities.

Broadcasting and Other Services

Airtel contributed indirectly to the broadcasting ecosystem through its data services and partnerships with digital content providers.

- Nationally, 25 million active decoder subscriptions and 2 million cable TV subscriptions were reported, with Airtel supporting customer access through data bundles and Airtel TV platforms.