The Tanzania Communications Regulatory Authority (TCRA) published its quarterly report for April to June 2025, reflecting sector-wide performance across telecom, internet, mobile money, infrastructure, broadcasting, and fraud control. Yas Tanzania, one of the country’s fastest-growing operators, consolidated its position as the second-largest player in mobile subscriptions and continued to expand aggressively in digital finance and network infrastructure. This article provides a comprehensive overview of Yas Tanzania’s performance in all key areas.

Mobile Subscriptions

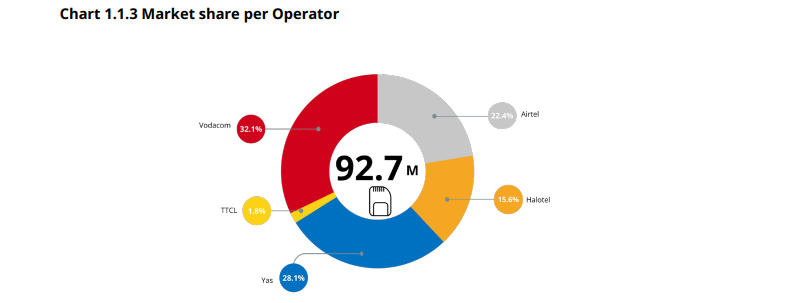

Yas Tanzania strengthened its market share to 28.1%, maintaining its position as the second-largest operator after Vodacom

- Active subscriptions grew from 25.4 million in March 2025 to 26.1 million in June 2025, outpacing Airtel (22.4%).

- This growth contributed significantly to the national total of 92.7 million active SIM cards.

- Yas’s success reflects its competitive pricing, strong brand appeal among younger consumers, and expanding coverage footprint in both urban and semi-urban areas.

Voice Services

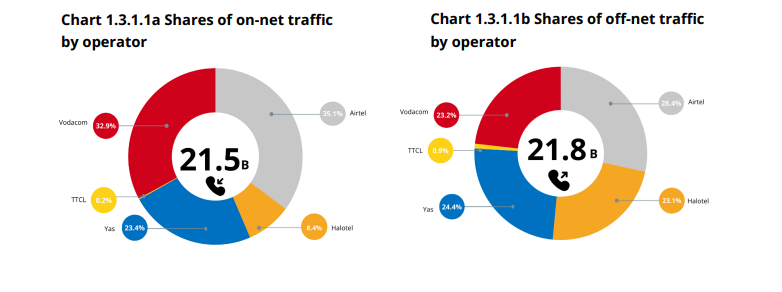

Yas recorded a strong performance in voice traffic, benefiting from its large customer base and affordable tariff structure.

- National domestic voice traffic increased by 6.6%, and Yas contributed a significant portion of the 43.3 billion total call minutes

- On-net traffic remained a key driver for Yas, supported by bundled voice promotions and loyalty programs.

- Off-net traffic terminating on Yas’s network represented a substantial share of the industry’s total interconnection minutes.

SMS Services

Yas remained a key driver in SMS volumes, building on its active user base.

- National SMS traffic increased by 6%, reaching 52.8 billion messages in June 2025.

- Yas benefited from bulk SMS and mobile marketing partnerships, with corporate clients using its platform for customer engagement.

- The company’s strong off-net traffic volumes underscore its growing influence in peer-to-peer and business-to-consumer SMS services.

Internet and Data Services

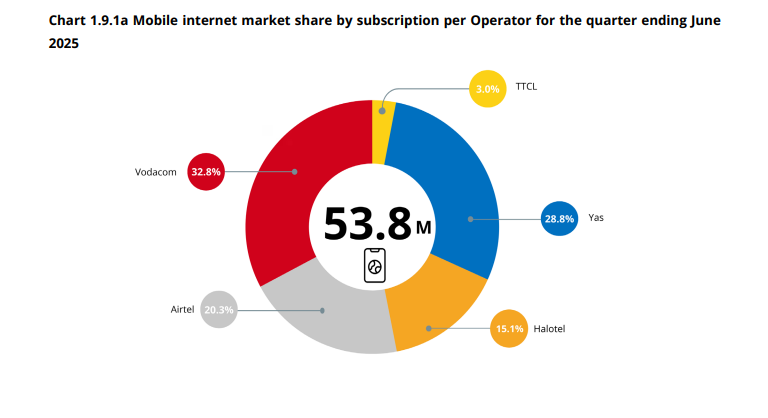

Yas demonstrated competitive growth in internet subscriptions and data usage.

- Out of the 54.1 million internet users reported nationally, Yas accounted for a significant share, leveraging its expanding 4G footprint

- Average national data consumption rose to 4.03 GB per user per month, with Yas subscribers contributing strongly to the national total of 633 petabytes consumed in June 2025.

- Speed tests placed Yas among the competitive operators, with average download speeds of 19.6 Mbps and latency performance at 113 ms, securing its position as a reliable broadband provider.

Mobile Money (Yas Mixx)

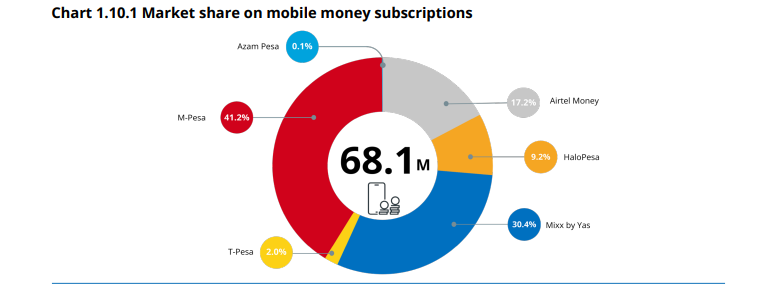

Yas Mixx continued to demonstrate strong growth, cementing Yas’s position as a serious competitor to Vodacom’s M-Pesa.

- Mobile money accounts increased nationally from 66.5 million in March to 68.1 million in June 2025, with Yas Mixx capturing 23.7% market share

- Yas Mixx, Airtel Money, and M-Pesa collectively controlled 89% of the mobile money market, with Yas showing the most consistent growth among the three.

- Transaction volumes rose significantly, contributing to the 5.27 billion transactions recorded nationally in the quarter. Yas’s digital financial ecosystem, which integrates merchant payments, bill pay, and peer-to-peer transfers, played a key role in this expansion.

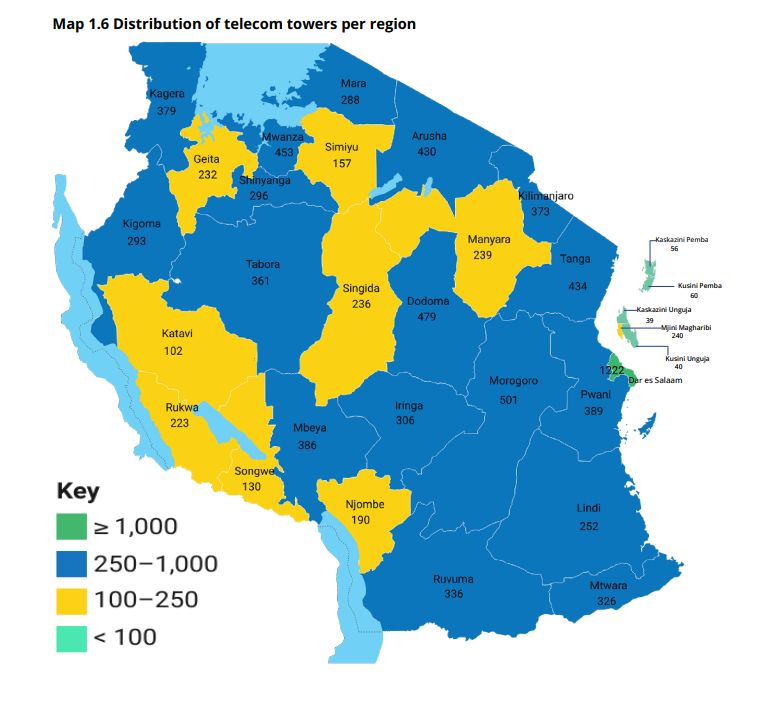

Infrastructure and Cell Towers

Yas continued to expand its infrastructure footprint to support subscription and data growth.

- By June 2025, Tanzania had 9,448 telecom towers, with Yas accounting for a substantial portion of this infrastructure

- Yas also invested heavily in 4G and 5G rollouts, increasing its national coverage and enhancing customer experience in high-density regions.

- Its infrastructure strategy aligns with the national coverage figures: 2G at 98.6%, 3G at 93.4%, 4G at 92%, and 5G at 26%, where Yas is actively contributing to rapid expansion.

Quality of Service (QoS)

TCRA’s independent QoS assessment placed Yas as the top-performing operator across several indicators:

- Network availability: Yas met the >99% requirement in all measured regions

- Call connection success rate: 100% compliance across all regions.

- Call drop rate: Yas achieved the lowest call drop rate among all operators, consistently below the <2% threshold.

- Download speeds: Yas averaged 19.6 Mbps, competitive against Vodacom’s 22.4 Mbps.

- SMS delivery: Yas achieved the <2 seconds delivery time standard across all test locations.

- Overall, Yas scored a perfect 100% in QoS compliance, ranking first among all national operators.

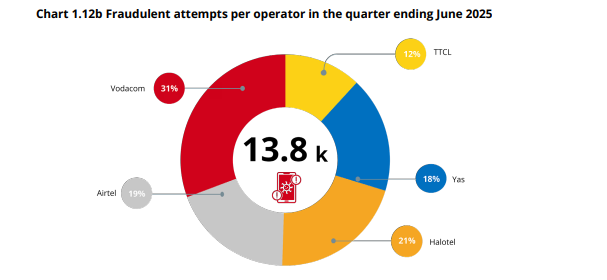

Fraud Attempts

While fraudulent activity declined nationwide by 19%, from 17,152 cases in March to 13,837 in June 2025, Yas reported the lowest number of fraud attempts among major operators

- This performance reflects Yas’s robust fraud prevention systems and strict monitoring of SIM registration processes.

- Compared to Vodacom, which recorded the highest fraud attempts due to its scale, Yas demonstrated resilience in managing risks across its network.

Broadcasting and Other Services

Yas contributed to the expansion of broadcasting services, including support for decoder activations and digital content distribution.

- The national total stood at 25 million active decoder subscriptions and 2 million cable TV subscriptions, with Yas indirectly supporting this ecosystem through data services and partnerships.