The Tanzania Communications Regulatory Authority (TCRA) released its quarterly communications report for April to June 2025, capturing developments across telecom, internet, mobile money, broadcasting, and postal services. Vodacom Tanzania, the country’s largest operator by market share, demonstrated resilience and growth across multiple categories, while also facing competition and regulatory challenges. This article highlights Vodacom’s performance across all key indicators, with a focus on mobile subscriptions, mobile money, infrastructure, traffic volumes, quality of service, and compliance.

Mobile Subscriptions

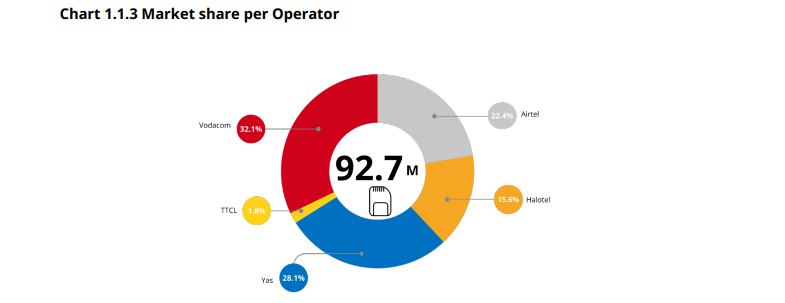

Vodacom maintained its position as the market leader in mobile subscriptions, commanding a 32.1% share of the market.

- Vodacom’s subscriptions grew from 25.5 million in March 2025 to 26.0 million in June 2025, strengthening its leadership against Yas (28.1%) and Airtel (22.4%).

- Vodacom contributed significantly to the national total of 92.7 million active SIM cards, underlining its dominance in both person-to-person (P2P) and machine-to-machine (M2M) segments.

- The company’s subscriber base was concentrated in urban and semi-urban regions, with Dar es Salaam leading nationally at 17.07 million subscriptions.

Voice Services

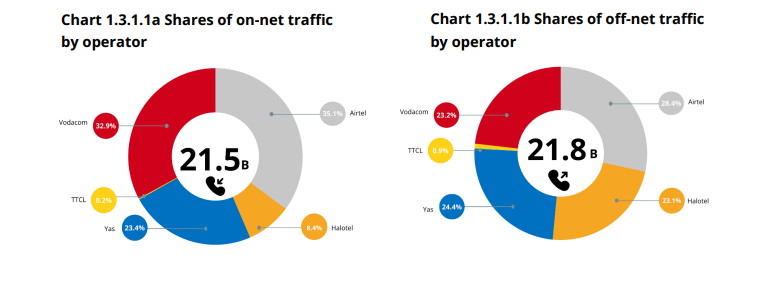

Vodacom delivered a strong performance in voice traffic during the quarter.

- On-net and off-net traffic from Vodacom’s network represented a substantial share of total national usage, with 28.4% of all off-net traffic terminating on its network

- Overall, Vodacom maintained its position as one of the top contributors to the 43.3 billion minutes of voice calls recorded nationally, reflecting sustained customer reliance on its network for voice communication.

SMS Services

Vodacom also remained a key driver of SMS traffic.

- National SMS traffic increased 6%, reaching 52.8 billion messages. Vodacom contributed significantly to this growth, benefiting from its extensive customer base and strong business-to-consumer (B2C) messaging partnerships

- With a large proportion of off-net traffic directed towards its subscribers, Vodacom sustained its role as a central player in SMS services.

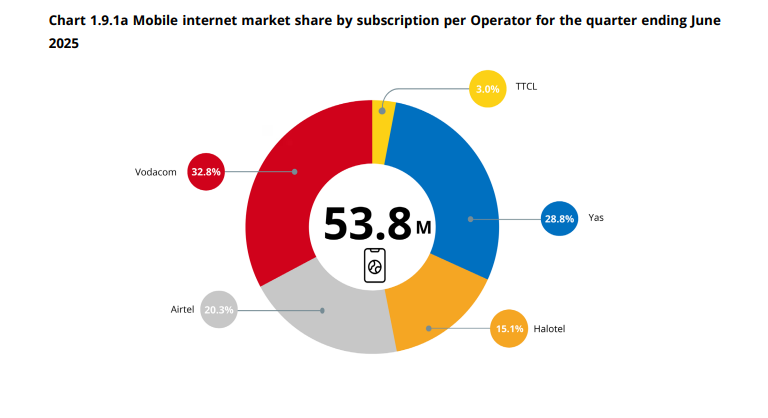

Internet and Data Services

Vodacom’s leadership extended into internet usage and mobile data traffic.

- TCRA recorded 54.1 million internet subscriptions nationally, and Vodacom captured a substantial portion of this figure through its 4G and expanding 5G networks

- Vodacom’s customers were among the largest consumers of data, contributing to the national total of 633 petabytes, a 14.7% increase from March 2025.

- Average usage reached 4.03 GB per subscriber per month, with Vodacom maintaining competitive speeds. Independent tests recorded average download speeds of 22.4 Mbps and strong latency performance at 109 ms, positioning Vodacom ahead of several competitors.

Mobile Money

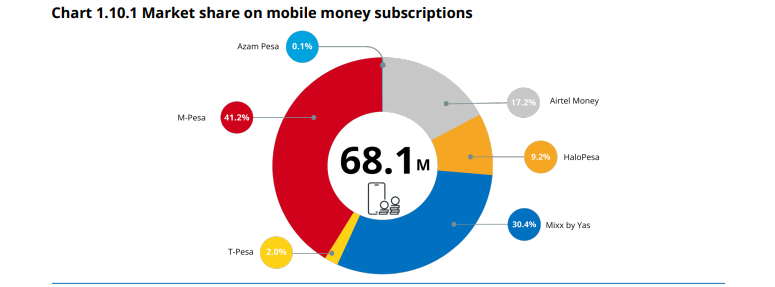

Vodacom’s M-Pesa service remained the market leader in mobile money.

- National mobile money subscriptions increased from 66.5 million to 68.1 million, with M-Pesa capturing the largest share at 41.2%

- Vodacom’s transaction volumes contributed heavily to the 5.27 billion transactions recorded across all providers in the quarter, affirming its dominance in Tanzania’s digital finance ecosystem.

- This scale underscores Vodacom’s continued role in driving financial inclusion and enabling payments across sectors from retail to government services.

Infrastructure and Network Expansion

Vodacom continued to invest in infrastructure expansion to support growing demand.

- Of Tanzania’s 9,448 telecom towers, Vodacom owned and operated the largest share, with a concentration in Dar es Salaam and other high-density regions

- Vodacom also led in radio base station deployment, with a significant share of the country’s 13,736 4G eNBs and expanding into 5G with active gNB sites.

- Network coverage highlights:

- 2G: 98.6% population coverage

- 3G: 93.4%

- 4G: 92%

- 5G: 26% (with Vodacom leading deployments in urban centers)

Quality of Service (QoS)

TCRA’s independent measurements placed Vodacom among the best-performing operators:

- Network availability: Vodacom met the >99% compliance requirement in 16 out of 17 service areas

- Call connection success rate: Vodacom achieved above the 98% threshold in 16 out of 17 service areas.

- Call drop rate: Vodacom stayed within the <2% standard in 16 out of 17 areas.

- 4G service coverage: Vodacom passed compliance in 16 out of 17 regions.

- Download speeds: Vodacom achieved an industry-leading 22.4 Mbps average.

- SMS delivery time: Vodacom passed the <2 second delivery standard across all regions.

- Overall, Vodacom achieved a QoS performance score of 94.7%, ranking among the top two operators nationally.

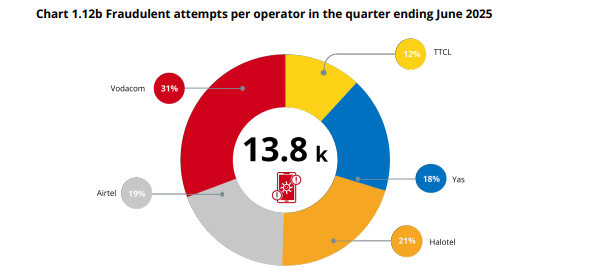

Fraud Attempts

TCRA reported a 19% decline in fraudulent attempts nationwide, from 17,152 in March 2025 to 13,837 in June 2025

- Vodacom, however, registered the highest number of fraud attempts among all operators, reflecting its large customer base and extensive reach.

- Despite this, Vodacom strengthened compliance and fraud detection systems, working closely with regulators to mitigate risks in SMS and voice fraud cases.

Broadcasting and Other Services

Vodacom continued to support broadcasting and digital content services through partnerships, contributing to the growth of active decoder subscriptions (25 million nationally) and cable TV subscriptions (2 million)