Africa’s banking sector has grown significantly in recent years. Leading banks are expanding services, modernizing account‐offerings, and leveraging digital channels to meet the needs of individuals, businesses, and the informal economy.

Standard Bank Group (South Africa)

Standard Bank is one of Africa’s oldest and largest banking groups.

Account types offered

- Personal / Retail bank accounts (current/checking accounts)

- Savings accounts

- Business / Corporate accounts

Other services

- Digital banking: internet banking, mobile apps, remote / self‐service banking

- Payment cards (debit / ATM cards)

- Foreign exchange and treasury services (for business clients)

- Detailed statements, cash management solutions, multi‐currency options for international transactions

National Bank of Egypt (Egypt)

One of the largest and oldest banks in Egypt, state owned.

Account types offered

- Savings accounts, including special savings pools and pension‐saving accounts

- Investment / certificate accounts (“B” investment certificates) with fixed maturity

- Checking / current accounts (for receiving salary, remittances etc.)

Other services

- Remote & digital account opening via online platforms, mobile, or by visiting branches

- Electronic banking, mobile banking, Internet banking

- Interest / returns on savings and investment accounts; competitive interest rates on certain certificates

Attijariwafa Bank (Morocco)

A major pan‐African bank with presence in many countries.

Account types offered

- Personal / Individual accounts, including youth, “Moroccans of the World”, very small business profiles etc.

- Savings accounts and checking/current accounts; overdraft options up to a certain limit for eligible customers.

- Business / Corporate accounts, package offers for SMEs, packages for foreign / offshore companies.

Other services

- Digital banking: mobile app (“Attijari Mobile”), online banking, remote banking 24/7

- Payment cards (debit / VISA / contactless)

- Overdraft facilities (subject to approval)

- Insurance, assistance (e.g. card loss, theft), loyalty / club packages

- Specialized packages: cash management, export finance, trade finance, financial institution services

Bank of Africa – BMCE Group (Morocco)

Also known as BANK OF AFRICA (BMCE), an important player in Moroccan and regional banking.

Account types offered

- Checking / current accounts in MAD for daily transactions.

- Savings accounts in local currency (MAD).

- Convertible Dirham accounts and foreign currency accounts for expatriates, tourists, or those with foreign income streams.

Other services

- Remote banking platform (BMCE Direct), online account opening, digital services for managing cards, PINs, statements etc.

- Free checkbook, insurance / assistance packages, subscription to other banking products

Banque Misr (Egypt)

A large state‐owned bank, with wide retail presence.

Account types offered

- Savings accounts: Al‐Momken Saving Account (for people of determination), Al Mongez Saving Account, etc.

- Current / Checking accounts: e.g. Hewalty Account in EGP & USD; Super Cash Current with daily interest.

- Islamic banking / Shariah‐compliant accounts (e.g. Kenana Plus).

Other services

- Debit cards, cheque books issued for current accounts.

- Digital banking: mobile banking, internet banking, IVR (interactive voice response) for account inquiries.

- Joint accounts, free or reduced fees for certain account types or time‐periods

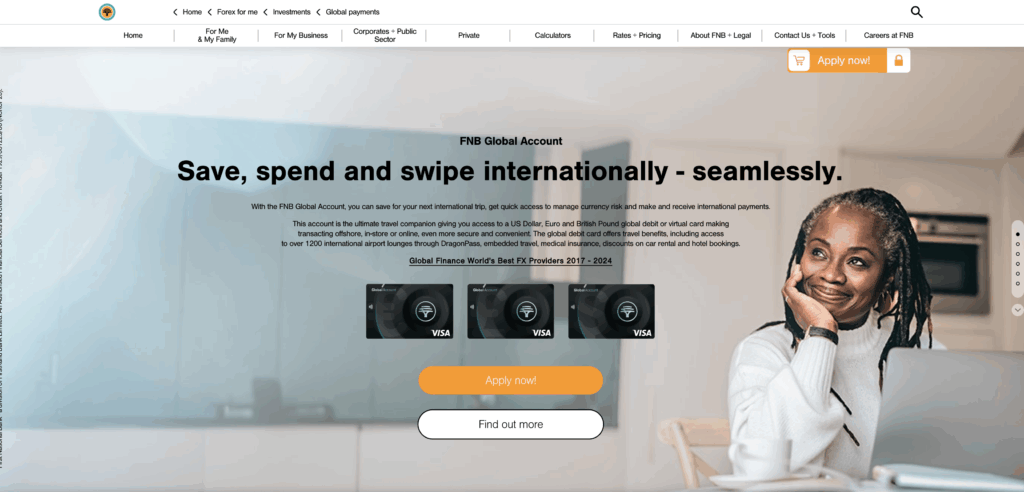

FirstRand (South Africa)

FirstRand operates through brands such as FNB (First National Bank) and is among the largest financial groups in South Africa.

Account types offered

- Current / cheque accounts (multiple tiers – e.g. standard, premium).

- Offshore / Global accounts allowing foreign currency holdings.

Other services

- Full suite of digital banking via app, internet banking

- Rewards / loyalty programmes (for example, eBucks)

- Value‐added services: data bundles, prepaid services, vouchers, etc.

- Support for businesses, public sector banking with tailored savings, investment options, guarantees etc.

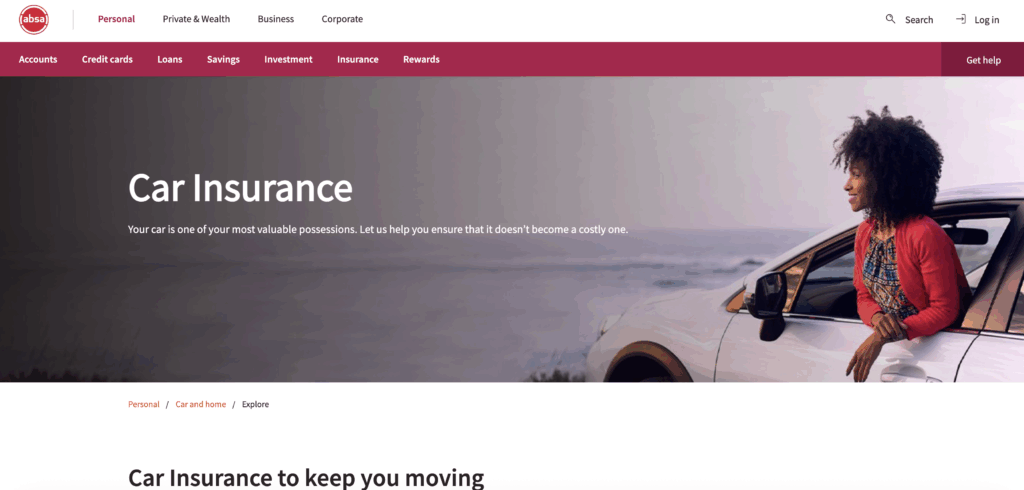

Absa Bank (South Africa)

Account types offered

- Transact Account a low‐cost entry level transactional account.

- Ultimate / Ultimate Plus / Premium Banking current / cheque accounts for higher income / premium clients, with more benefits.

- Youth / Student / Graduate / Senior accounts – accounts tailored for younger clients or seniors with lower fees or special benefits.

- Private Banking / Wealth / Family Banking Bundles – for high-net-worth individuals and families.

Other banking services

- Digital banking: Absa Banking App, online banking, digital wallet / contactless payments.

- Debit cards, credit cards, overdraft facilities for eligible accounts.

- Rewards / loyalty programmes (e.g. Absa Rewards) – cashback etc.

- Fee discounts for certain usage or maintaining minimum balances; free or cheaper transactions (ATM, electronic) depending on the account tier.

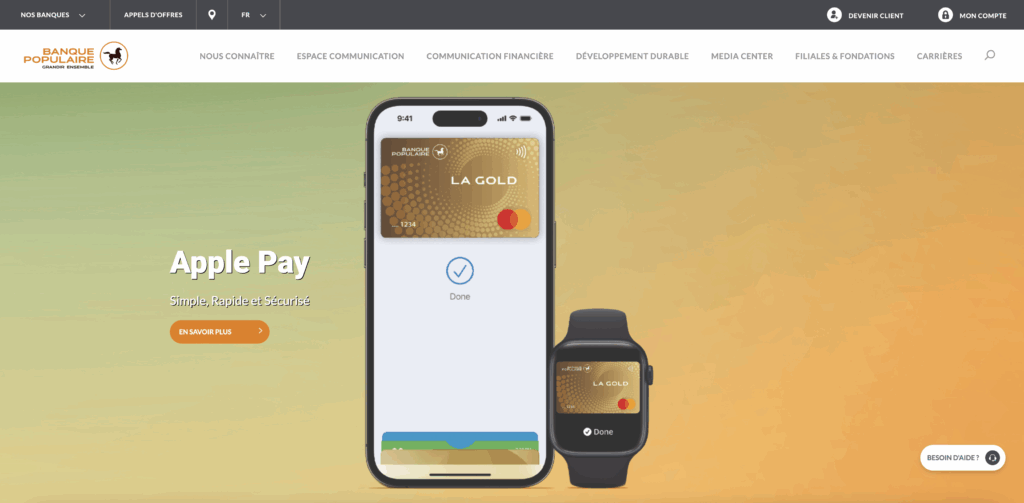

Banque Centrale Populaire (Morocco)

Account types offered

- Convertible Dirhams Account a checking / current‐type account in Moroccan Dirhams, with capacity to make foreign currency transfers abroad.

- Foreign-Currency Accounts for professional or corporate clients holding foreign currencies to do business abroad, import/export etc.

- Current Accounts for SMEs / professionals.

- Savings / Bankbook accounts (in dirhams) deposits with free withdrawals and interest on available balance, no fixed term.

Other banking services

- Remote banking / online banking (Chaabi Net) and mobile app services for individuals, professionals, and corporations.

- Trade finance, foreign‐exchange operations for business clients. Convertible accounts help with managing exchange exposure.

Nedbank Group (South Africa)

Account types offered

- Savings / Investment accounts:

* JustSave immediate access savings.

* Group Savings (for clubs, stokvels etc.)

* Notice accounts (32-Day Notice, Electronic 32-Day Notice) requiring notice before withdrawing.

* Fixed Deposit / Electronic Fixed Deposit accounts for longer term, committed savings.

* Tax-Free Savings Accounts and Tax-Free Fixed Deposits complying with SA legislation. - Transactional / Current Accounts:

* Low fee “everyday / basic” accounts (e.g. MiGoals for low-income clients) with minimal charges.

* Savvy Plus / bundled accounts combining transactional and savings features.

* Private / Premium / High-net-worth current accounts with additional perks.

Other banking services

- Digital banking: online banking, mobile app (Nedbank Money app), electronic statements.

- Overdrafts, debit and credit cards, rewards programmes (e.g. Greenbacks) for eligible accounts.

Foreign currency / money market investment services; notice accounts to grow funds; fixed deposits.

Banque Extérieure d’Algérie (BEA – Algeria)

Account types offered

- Regular bank accounts (comptes bancaires) opening of standard bank accounts.

- Savings / Placement / investment‐type accounts

Other banking services

- Mobile bank / app

- Online services: viewing balances, transactions, account statements; online transfers and maybe currency conversion.

- Credit / loan simulation, credit services: they offer credit simulators for financing.